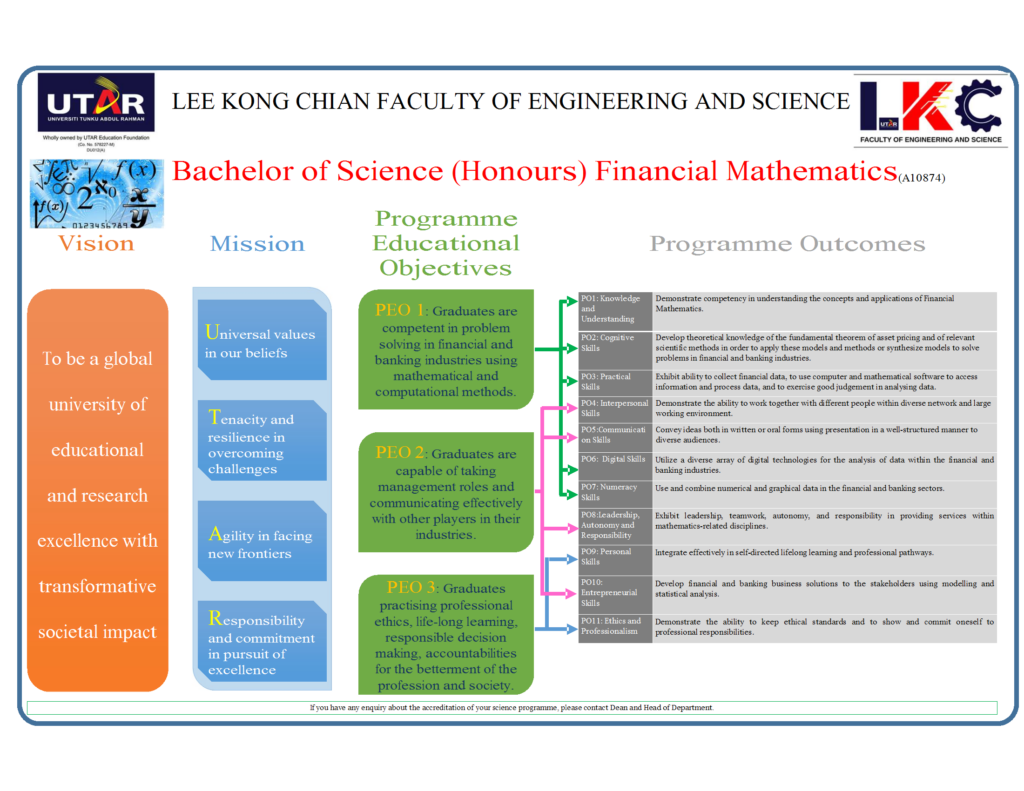

Bachelor of Science (Honours) Financial Mathematics(R3/0541/6/0001)(01/30)(MQA/A10874)

Nowadays, as the economic environment becomes more and more complicated, we need financial professionals who are capable of analyzing, evaluating, and planning for the global and regional economy. Hence, this programme focuses on producing graduates with advanced training in quantitative finance.

Mathematical finance draws from the disciplines of probability theory, statistics, scientific computing and partial differential equations to provide models and derive relationships between fundamental variables such as asset prices, market movements and interest rates. These mathematical tools allow us to draw insights and conclusions. For example, the theory of option pricing due to Black, Scholes and Merton allow us to assign a value to an option using arbitrage free arguments. This theory, for which Scholes and Merton were awarded the Nobel Prize in 1997, is an excellent illustration of the interaction between mathematics and financial theory.

Other than its application to trading and regulation, the theory of finance has now become increasingly mathematical that problems in finance are now driving certain areas of mathematical research.

Programme Learning Outcomes

Bachelor of Science (Honours) Financial Mathematics

(R3/0541/6/0001)(01/30)(MQA/A10874)

Bachelor of Science (Honours) Financial Mathematics: Full course name

R3/0541/6/0001: Course code

01/30: Expiry date (month/year)

MQA/A10874: Accreditation status and reference code